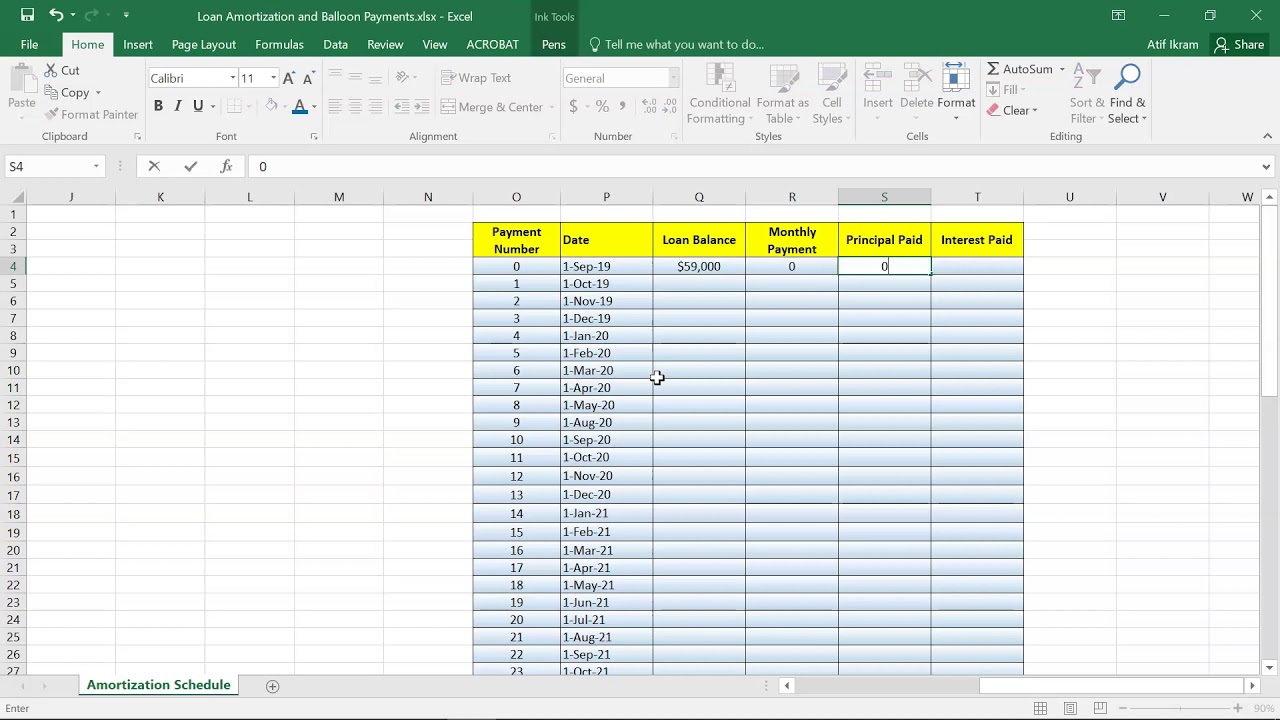

The function logical test will determine if the term period is less than or equal to the total payment.

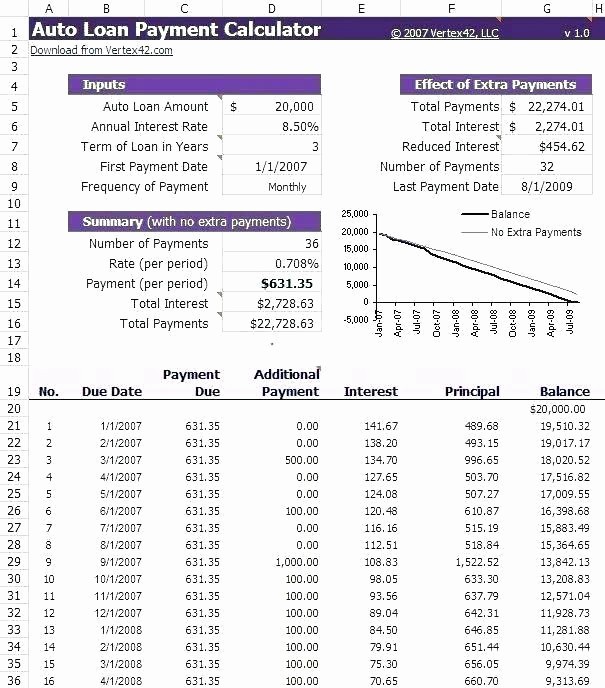

This is accomplished by enclosing each formula in an IF function. Step 2: Make a Schedule for the AmortizationĪs we have too many term periods, we may restrict the computations to the actual amount of payments for a certain loan. Finally, the Loan Amount which is $20,000.Also, we have the Payments Per Year which is 12, as our loan year is 1 so we need to pay the loan in the next 12 months. Actually, when cash goes to the other person in consideration for the return of the loan principal annual interest, this is referred to as a loan. Then, we have our Loan in years which is just 1 year.It mainly computes the annual proportion amount we need to pay.

An annual rate is started as an annual percentage rate.

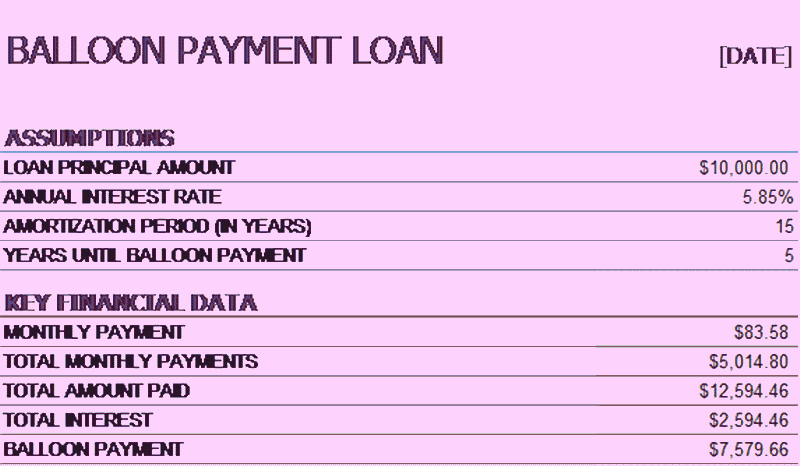

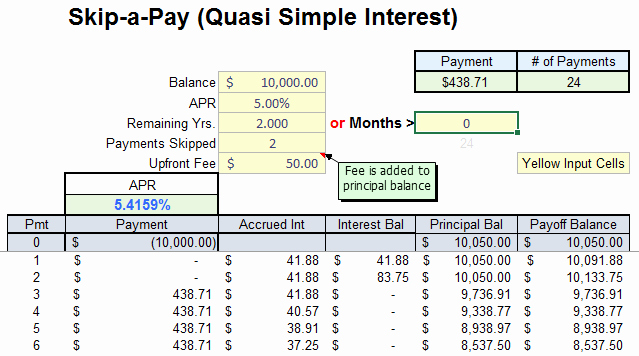

Actually, a balloon payment is something that does not amortize completely throughout the loan’s duration. What Is a Balloon Payment and Extra Payments in Excel?Ī balloon payment is yet another payment that is bigger than normal at the end of the loan period. Each payment is subdivided into principal and interest, and the outstanding amount is shown after each payment.Īn amortization schedule with the balloon payment and extra payments in excel is a very necessary plan while working with the loan department.

What Is an Amortization Schedule in Excel?Īn amortization schedule is a table format repayment plan specifying monthly bills on a loan or mortgage over a period of time.

0 kommentar(er)

0 kommentar(er)